Part 1

The most important item if you plan to invest,

is to be a good steward of the gifts you are provided and invest wisely. If you

are investing into any asset class, and decisions are based on this core fundamental and

underlying basis, your investing will be secure and investing rewards will follow closely. Without

following this reasoning, investing into property or shares turns into gambling

and a un-needed leveraging of ones finances to a point where a minor market

correction will create un-calculable losses.

So how do you create long term Security within your

investing portfolio?

Hard work. Investing is like any other job.

You work hard and smart and you get the reward. With your day job you work hard

and your boss may or may not give you a pay rise or a bonus. The bottom line is

the harder and smarter you work, it will increase your probability of getting a

higher wage or bonus. Same with investing you work hard and the market may or

may not give you a profit. If you put in

very little time to trading and investing you can only expect returns proportional

to your input, and in most cases you will lose money. Trading and investing is

a job. Viewed any other way your outcome and returns will reflect your input.

Firstly stop reading anything that is

promotional and advertising based, be it on the internet or through papers, TV,

radio etc. 99.9% of what you will read or hear about trading and investing will

have an ulterior motive. In most cases it is a business pushing their own

secrets, ideas, indicators, black box, programs etc. The normal story is "I

have made my millions using this exact system and now, out of the love for

society and humanity I am spreading the word and helping you the individual to

also create untold wealth and cash flow and live happily thereafter. Just pay a

small fee of 200$ and my secret will be shown you with ongoing day to day

training provided etc. etc.". If someone is sharing anything with you that

is not mathematically possible and fits within the average returns of what is

possible profit to remove from the market,

it’s always bullshit. I hate to burst anyone’s bubble but there is no

secret nor any strategy wall street has not heard about. It’s just sales and a

flashy website. Put it another way, a trader or property investor may not be

aware something is possible due to their limited education, but there are no

secrets.

There are a lot of elements so we will break

it down.

Capital Protection

Banks.

Whilst this may seem obvious and

redundant anyone who remembers the 2008 (or previous) Financial crises will remember banks going

bankrupt. Is the bank where you hold

your capital or where your broker holds your capital, have a good credit rating, and are they preferably be backed by the government in times of financial crises. Is

the broker you are using holding your money in a separate segregated account or

does your broker have access to your funds for hedging, trading etc to generate

profit for the brokerage business. You want your capital in a Segregated

account to ensure that if the broker goes bankrupt your assets can be returned

to you.

Broker.

What type of broker are you

dealing with?

i) Market Maker broker (MM) - a market maker

is a broker who makes the market on the other side of your buying and selling.

With today’s technology it is very easy to setup a MM company and business. The

core strategy of the MM business is to generate profit. The MM business know

that 95% of traders will lose money. So based on that statistic they know they

have a 95% probability of making profit every time their clients trade. In

short, MM business core business profits, come from their clients losing money.

Put another way, if the client believes they have a "special" strategy

that will make money from a MM broker they will ultimately mean the MM company

will lose money. As a business the MM will do everything in their power to

ensure they as a business will not lose money. Same as any other prudent

business owner in any field. So my question is, do you as an investor wish to

be on the other side of a business whose core strategy is to make money from their

clients losing money? Even if the trader is really good, how safe is your

capital if you are trading to send the broker bankrupt?

ii) Binary Options. This is officially the

scam of the century. For a mere $50k or less, a person can setup a binary

options business. It holds the same risk and problems as the MM business except

on a more obvious level. With MM at least they try to replicate the underlying

investment instrument. With binary options there is no legal obligation to do

this. It is too easy for the binary option backend algorithms to ensure that

the business makes profit from its clients. This is exactly same level as a

casino. Yes an individual may be able to generate a profit by playing slot

machines once every now and again, but as a whole the house wins. The house has

to win, otherwise the house has no business.

The only way to trade and ensure you are

investing where the company/business on the receiving side of your trade is not

making money from you losing money is trading market direct. Investing is hard

enough without having your broker betting against you to loose. Let your broker

make their money by simple transparent brokerage fee. Every investor has their

own strategy some are long term investors, some are short term investors, some

are going "long" the market some are going "short" the

market, but the point is they are all trading the underlying value of the stock

and profiting or loosing from its direct share price movement.

When selecting a broker an investor needs to

ensure that they are trading the underlying instrument direct. Meaning if you

are trading stocks like aapl, you actually are trading aapl direct and can get

a shareholding certificate from your broker if required. If the investor is

trading the futures market e.g. barrel of brent crude oil then then investor is

trading the underlying direct. Whilst most brokers these days won’t let the

investor receive the delivery of the underling

future, and will roll the futures contract forward to the next month(e.g.

receive the actual barrels of oil at expiry) , the point is that the trader is

trading the direct underlying instrument.

Forex

market. There are 2 ways to trade forex that is trading the market

direct with the futures and options market, the other is through a forex online

broker that uses ECN (electronic Communications Networks) and receives

commission through spread (some of these brokers forfeit their spread and

charge brokerage commission but it is still the same backend). There are 2

types of foreign exchange brokers, that are not futures foreign exchange

contracts backed. One is MM which we have covered previously the other is ECN

with straight through processing(STP). The ECN will have a direct link to any

number of banks which will take the other side of your trade and provide

liquidity to you the trader, and then in turn the broker will receive a

commission from the widening of spread. So, whilst using a ECN broker with low

spreads is an almost viable option, the problem lies in the fact that there is no

actual exchange in this forex market so volume cannot be tracked as there are multiple

ECNs using different banks through different brokers. This also means

open-high-low-close prices vary depending on where you get your data from. To

clarify there are traders who use this different potential pricing between ECNs

to hedge and generate profits through the Spread between the different banks. It’s

a game on a big scale, one you should not be looking into. If you trade foreign

exchange the best way is to trade the futures market direct and using the

futures options.

Trading is hard enough without having your

broker taking the other side of your position and using that hedge, to generate

a profit in order to stay in business.

When

selecting a Broker be mindful of the pitfalls and how that will impact your

financial security and also your ability to generate a profit.

CFDs (Contract for Difference)

There

are 2 types of CFD’s, one is direct market access (DMA) and the other is MM as

discussed in point i. Point i provides enough information on the risks of mm

services. If your broker charges you a brokerage fee per trade, and is not

making money on the spread, and is DMA, this can be used as an effective hedging

tool. Whilst not the same security level as

direct shareholding, DMA CFDs are an effective investment vehicle

because a DMA CFD pricing is directly linked to the underlying instrument.

Now that we know our capital is not going to

disappear due to some dodgy bank or brokerage business we can move onto

strategy. Once a broker has been selected it is time to move onto how to be

prudent investor investing into the underlying instrument’s an investor wishes

to get involved in.

Leverage. A common reason why people go with

CFDs and MM is the attraction of leverage for small accounts. If your reason

for going with a broker is because of the leverage provided to your account,

maybe your problems are bigger then this article can cover.

First is capital protection, second is

trading underlying direct instruments and third is strategy. You need to be a

profitable trader before you worry about leverage. If you can’t trade

profitably on an ongoing year after year basis no amount of leverage will help you.

Rather the opposite will happen leverage will ensure you lose all your money

really quickly if you don’t have a solid and profitable trading strategy.

There is a lot of different strategies and

concepts that are profitable if the investor is willing to put in the hard

work. There is no free lunch.

Prudent Investing Points

Number 1.

Don’t believe anything any one tells you,

believe only the outcome and proof you need to ensure the trade suits you and

where you are at right now in your learning curve. If your broker says buy this

stock, ask them why... and then prove it to me... and then what price are you

the broker on your personal trading account going to buy this stock.... can you

show me your share certificate to prove the purchase... are you telling me to

buy because you have already bought the stock and need to sell to someone....

what price and when are you going sell... why... you get the idea. But this is life

in general with everything you do, you need to question it.

I have a saying

" the results you get are based on the

quality of questions you ask yourself" …. If you ask yourself crappy

questions, you will then ask people questions that really are not worth a grain

of salt, which in turn will reflect on your outcome.

Number 2.

Setting realistic expectations. The market

both property and shares have only so much movement in them, meaning the market

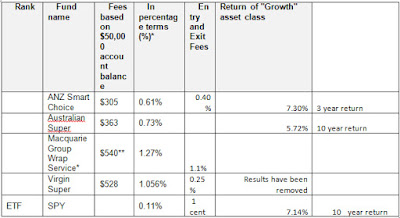

can only give you the investor a certain amount of return. If the benchmark ETF

(e.g. spy for the US market) (ETF = Exchange Traded Fund) returned 10% last

year and the top hedge funds returns were 15% in the same time period, why do

you think that there is some secret that you can make 100% over the same time

period. Is it not obvious that if it was possible to consistently outperform

the relevant benchmarks by 10x that the hedge fund would be doing that? Hate to

break the news but hedge funds have billions of dollars in net worth, they have

teams of PhDs and Dr’s and other people that are a whole lot smarter than us,

and yet their returns are still within the reasonable realm of possibility.

That should be telling you something.

It is known that most floor traders and professional

traders target about 18 to 20% per annum to cover costs. That is a realistic

figure and anything above that is cream, but should not be expected as the

norm.

I know it cliche but the core goal, is to be

a prudent investor, and ensure your capital loss-risk, is minimized. Returns

will naturally happen if this is done correctly.

Number 3.

1. Invest into ETFs. I don’t believe in

investing in a range of stocks to build a “diverse” portfolio and to “spread

the risk” because we have seen from history that there is no benefit to this strategy.

When you are a beginner, investing into individual stocks is fraught with danger

and as an investor you need to be prudent with your capital. So investing into

individual stocks is not prudent investing for a beginner. Rather what I am

talking about here is investing into ETFs. The easiest way to protect your

capital is via ETFs where ETFs are a pool of stocks. From a risk perspective if

one stock goes bankrupt and no longer trades the ETF may go down in value but a

traders position will not go down to 0$, this is due to all the other holdings

the ETF own shares in are worth some sort of value.

2. Invest into non-correlated underlying’s.

This means if one stock goes down in value the other will increase in value.

This strategy itself will not specifically generate profits but will ensure

that the capital of the investor is protected. One thing we have learnt over

the last 5 years or so is that when the market crashes, everything falls in

value. The old saying of diversification in stocks is no longer relevant,

diversification is no use if all stocks fall at once as seen in 2008 market

crash. Your portfolio also needs to be non-correlated.

3. Trade small. There is no specific size value

but the point is to have a good understanding of the notional value of the

underlying you are trading. If the notional value dwarfs your account balance

you will have problems and your risk of blowing up your account is increased. A

common strategy is using ES futures contracts to generate a profit, and you

will hear a lot of new traders talking about their returns. Never mind their returns

are calculated on their margin amount, not on the notional value of the futures

contract. Should the market go against their position the losses will increase

rapidly and turn into a large problem.

The rest of my blog covers actual strategies

that you as an individual investor may find suitable based on your personal preferences.

Note: this article is about MM who make a

market on synthetic manufactured underlying’s loosely replicating the underlying

and whose core strategy is to generate profit from these. In the real trading

world MM can provide a good benefit to the market in the form of providing

liquidity to the market directly through the markets shares or futures

contracts. High frequency trading firms also provide liquidity benefits to the

market and are a strong asset to the business.